Monday 31 December 2012

Happy New Year !!! 2013 here we come.....

Thursday 20 December 2012

20Dec2012 -REITS review

Well, tomorrow will be Doomsday .....21Dec2012 according to the Mayan Calender. We are 1.5 hours away for this date, and time is ticking. Hmm....not many believe this but more people is believing there will be a blackout for 3 days, the effect of this day. Well, if tomorrow is the last day, I still got a lot of things in my life that I haven't try or enjoy, haha. No choice, tomorrow still got to work.

Lets see, CMMT have been going short term down trend for 7 weeks, and today seems like a rebound and broke the immediate downtrend line with some volume. Seeing the bullish divergence show by MACD histo, she strongly indicates that she will climb to her 1st resistance. This resistance is quite a strong one, she really need a good volume especially those big fish to push her through before she able to re-challenge her previous intraday high of 1.98.

Lets see how she goes. Btw today is an up day for Sunreit and IGBReits also. Sunreit broke out from her Symmetrical triangle with a good volume. Stochastic still climbing (Smooth %D yet to touch overbought). MACD histo turn Green. MACD has bullish crossover the centre line.

For IGBReit, nothing much exciting. The only positive thing is 5MA has stayed above 20MA. When you compare this reit with the two above, she really disappoint in terms of performance since her IPO launch. Lets see, she will show some strength in coming weeks. I believe if she able to break 1.35 convincingly with good volume, she will propel with a "V" shape as like those good Fundamentals IPOs. Time will tell.

Lets see, CMMT have been going short term down trend for 7 weeks, and today seems like a rebound and broke the immediate downtrend line with some volume. Seeing the bullish divergence show by MACD histo, she strongly indicates that she will climb to her 1st resistance. This resistance is quite a strong one, she really need a good volume especially those big fish to push her through before she able to re-challenge her previous intraday high of 1.98.

Lets see how she goes. Btw today is an up day for Sunreit and IGBReits also. Sunreit broke out from her Symmetrical triangle with a good volume. Stochastic still climbing (Smooth %D yet to touch overbought). MACD histo turn Green. MACD has bullish crossover the centre line.

For IGBReit, nothing much exciting. The only positive thing is 5MA has stayed above 20MA. When you compare this reit with the two above, she really disappoint in terms of performance since her IPO launch. Lets see, she will show some strength in coming weeks. I believe if she able to break 1.35 convincingly with good volume, she will propel with a "V" shape as like those good Fundamentals IPOs. Time will tell.

Tuesday 11 December 2012

What would you do after you strike your first bucket of gold ?

Smart People start to use money to earn more money after striking their first bucket of gold by doing business. Some of them get richer but some of them back to square one.

Lets put up a scenerio for discussion,

You just strike a Toto and the prize is RM3.5 million. Wow ! The whole night you would not able to sleep. Lets begin, you might use RM500k for giving yourself a treat, example a luxury car, a new house, a lot of electronic gadgets that you always dream on. Then you left with RM3 million. Lets talk business, how you want to let the money grow to ensure you have enough money to live the rest of of life by quiting your current pressure cooker job ! Imagine your family income (include your wife) is RM7.5k per month ( RM90k annually). Here are a few options

1) Put all the money into Fix Deposit and earn 3% annually = RM90k .

Pro : Your money is 100% safe and consistently you & your wife can quit your jobs and have RM90k to spend annually which you can maintain your current life style

Con : Year by year, there is inflation of around 4~5%, thus your spending power getting lesser and lesser, which you may eat into your capital and you may have nothing much left over for your children by the time you leave this world.

2) Put all the money into a few Dividend stocks = (around 6% for REITS would be good) = RM180k.

Pro : You can use RM90k for the 1st few year and re-invest back the RM90k into the dividend stocks, with this your capital will keep growing and this will definitely cover the inflation and also indulge into some extra luxury items or tours.

Con : Your capital may not guarantee to maintain if the stocks you purchase keep dropping in price. So, the annual income may also fluctuate though you still get RM90k annually if your stock price drop to half price from your purchase price.

3) Put RM1 million into FD (interest RM30k), RM1 million into dividend stocks (dividend RM60k), RM1 million to trade ( assume you have acquire the necessary TA skill needed to trade), well target 15% annually consistently . So total annual income would be RM240k.

Pro : You can upgrade your lifestyle and also grow richer than your current wealth with this combination as you can use the extra money earn that you did not finish spending for trading capital.

Cons : If you lose 10% for a particular year, then one have to eat into his RM3 million capital as the RM90k earn from FD & dividend is not enough to cover the 10% lost, not to say the daily expenses.

Personally, I would opt for option 3, test our for say 5 years, if the growth is lesser than option 2, then I will switch to option 2 .

So, which one would you choose ? Lets share your view ;)

Lets put up a scenerio for discussion,

You just strike a Toto and the prize is RM3.5 million. Wow ! The whole night you would not able to sleep. Lets begin, you might use RM500k for giving yourself a treat, example a luxury car, a new house, a lot of electronic gadgets that you always dream on. Then you left with RM3 million. Lets talk business, how you want to let the money grow to ensure you have enough money to live the rest of of life by quiting your current pressure cooker job ! Imagine your family income (include your wife) is RM7.5k per month ( RM90k annually). Here are a few options

1) Put all the money into Fix Deposit and earn 3% annually = RM90k .

Pro : Your money is 100% safe and consistently you & your wife can quit your jobs and have RM90k to spend annually which you can maintain your current life style

Con : Year by year, there is inflation of around 4~5%, thus your spending power getting lesser and lesser, which you may eat into your capital and you may have nothing much left over for your children by the time you leave this world.

2) Put all the money into a few Dividend stocks = (around 6% for REITS would be good) = RM180k.

Pro : You can use RM90k for the 1st few year and re-invest back the RM90k into the dividend stocks, with this your capital will keep growing and this will definitely cover the inflation and also indulge into some extra luxury items or tours.

Con : Your capital may not guarantee to maintain if the stocks you purchase keep dropping in price. So, the annual income may also fluctuate though you still get RM90k annually if your stock price drop to half price from your purchase price.

3) Put RM1 million into FD (interest RM30k), RM1 million into dividend stocks (dividend RM60k), RM1 million to trade ( assume you have acquire the necessary TA skill needed to trade), well target 15% annually consistently . So total annual income would be RM240k.

Pro : You can upgrade your lifestyle and also grow richer than your current wealth with this combination as you can use the extra money earn that you did not finish spending for trading capital.

Cons : If you lose 10% for a particular year, then one have to eat into his RM3 million capital as the RM90k earn from FD & dividend is not enough to cover the 10% lost, not to say the daily expenses.

Personally, I would opt for option 3, test our for say 5 years, if the growth is lesser than option 2, then I will switch to option 2 .

So, which one would you choose ? Lets share your view ;)

Monday 26 November 2012

TM- Still a good Fundamental Stock ?

I always been telling my friends, if we had bought TM around Mar2008 after the KLCI drastic crash of 350 pts , then we would have been holding a totally free of cost stock. You can see from the dividend adjusted stock, it is adjusted till RM0.00 on Mar2008. Meaning, the dividend and the capital repayment has paid all the cost of the stock if we would had purchase around that time. And till now, even TM has been drop for weeks already, one would still have a gain of RM5.28 without using a single cent. Cool right ? Will TM still give such generous dividend or capital repayment in the next few years ?

What about her Technical Landscape? Those who like to catch Falling Knife or the Waterfall play.

Is it time ? Lets take a look on the daily chart. Seems like the bearish volume is diminishing, and the

stochastic and MACD is showing a littler sign, they want to cross-over. For those aggressive type,

one may start accumulating around this price, for those conservatives, maybe a bullish crossover would

be a good. By that time, will she be support around 5.25 or 5.00 (strong support). Lets see how the price pans out.

What about her Technical Landscape? Those who like to catch Falling Knife or the Waterfall play.

Is it time ? Lets take a look on the daily chart. Seems like the bearish volume is diminishing, and the

stochastic and MACD is showing a littler sign, they want to cross-over. For those aggressive type,

one may start accumulating around this price, for those conservatives, maybe a bullish crossover would

be a good. By that time, will she be support around 5.25 or 5.00 (strong support). Lets see how the price pans out.

Saturday 10 November 2012

Top Glove Target achieved !

As I said it a short play ! Target of 5.74 achieved on Friday. From the price-volume and stochastic indicator she may retrace before continue her uptrend. Nevertheless, once a trading plan is set for short play and the target price has achieved, I would not hesitate to take profit ! ;)

Monday 5 November 2012

MP : Top Glove

Is been nearly 2 weeks since my last post. I've been down with chickenpox. Hmmm... imagine for a 40+ year old guy got infected with chickenpox is no play. Whole body & face & everywhere are those pox. When look at the mirror, just feel I'm like a zombie. Too many till my doctor decided to give me antibiotics instead of waiting for my own immune system to build up the whole defence system.

Okay back to stocks, Top Glove seems like moving slowly and climbing a short term uptrend. Just seeing today full of reds 362 losers vs 146 gainers , she still manage to chalk up 0.08 gain. Well, the next critical resistance would be around 5.50. Able to close convincingly with volume above 5.50 would see her at the next resistance 5.74 and then 6.00 (psychological). I believe this would be a short play, make it or lose it.

Okay back to stocks, Top Glove seems like moving slowly and climbing a short term uptrend. Just seeing today full of reds 362 losers vs 146 gainers , she still manage to chalk up 0.08 gain. Well, the next critical resistance would be around 5.50. Able to close convincingly with volume above 5.50 would see her at the next resistance 5.74 and then 6.00 (psychological). I believe this would be a short play, make it or lose it.

Wednesday 24 October 2012

Paramon follow-up

I mentioned about Deja vu on Paramon, http://reiccs.blogspot.com/search/label/Paramon and I'm expecting she need weeks to move. And she really takes her time, is already 4 weeks , really testing my patience.

And today she finally make some good move (4%). Lets, see if I can achieve my target in the coming 1 to 2 weeks.

And today she finally make some good move (4%). Lets, see if I can achieve my target in the coming 1 to 2 weeks.

CMMT target achieved !

Last week on Monday when she broke 1.80, she closes at 1.81 but with low volume, then I thought the

signal that I have mentioned on 13Oct will not turn true so quickly. Indeed she took around 1.5 week to

acheived my target of 1.93 and even high at 1.98 near my 2nd profit target of RM2. From my purchase

price of RM1.60 to RM1.93 is a 20% profit for a 3 months time frame. Hmmm...after seeing the time

frame, some may think is too long for them. For my standard, VI timeframe is expected to be longer, from 1 week to ?(I yet to decide). I used to keep some stock for more than 5 years but since I've learn TA especially trend trading, I do not have the patience for 5 years. Err...maybe Sunreit I would keep this long, lets see. For MP will be 3 days ~ 6 week play.

Well, what a momentum on the last hour :)

signal that I have mentioned on 13Oct will not turn true so quickly. Indeed she took around 1.5 week to

acheived my target of 1.93 and even high at 1.98 near my 2nd profit target of RM2. From my purchase

price of RM1.60 to RM1.93 is a 20% profit for a 3 months time frame. Hmmm...after seeing the time

frame, some may think is too long for them. For my standard, VI timeframe is expected to be longer, from 1 week to ?(I yet to decide). I used to keep some stock for more than 5 years but since I've learn TA especially trend trading, I do not have the patience for 5 years. Err...maybe Sunreit I would keep this long, lets see. For MP will be 3 days ~ 6 week play.

Well, what a momentum on the last hour :)

Saturday 13 October 2012

CMMT-Interesting technical set-up

Monday~Tuesday 15!16 /Oct is crucial to CMMT in TA terms.

On Friday, 12Oct, she shows a few of interesting signal :

1) reached resistance 1.80 with good VOLUME (touch for the 3rd time)

2) at this 1.80 resistance for the 3rd time is like previous 1.64 resistance, which was broken on the 3rd time.

3) and MACD is on the verge of bullish crossing.

4) this is also a Ascending triangle pattern, once break, the projected target would be RM2.

Well, I have been planning to clear my remaining qty in Aug around 1.85~1.89 if she reach in 1~2 weeks time. Well, time flies, she did not manage to reach my target within my time frame, so I have kept and change my strategy to VI.

So, next week this question will pose to myself again, should I sell at 1.89,1.93 or 2.00. Let see how the candlestick & volume during the next week and I will make a decision on this.

If really follow FA, here is a few TP by investment house.

| Analyse date | TP | Rec | Investment House |

| 9/10/2012 | 1.80 | HOLD | KENANGA |

| 13/09/2012 | 2.20 | BUY | HWANGDBS |

| 23/07/2012 | 1.69 | HOLD | RHB |

| 23/07/2012 | 1.62 | HOLD | MAYBANK |

| 23/07/2012 | 1.53 | HOLD | HLG |

| 23/07/2012 | 1.80 | BUY | CIMB |

| 23/07/2012 | 1.86 | HOLD | AMMB |

Tuesday 2 October 2012

2012 Q3 Trade/Investment Summary

Is time again for another review. This time is a 100% strike for MP strategy, though some did not go according to my trading plan time frame. This Q3, I'm adding in CMMT and IGBREIT as my VI stock as defensive play as we are still have an Election risk, right ?

Here you go.....

Wednesday 26 September 2012

Deja Vu for Paramon ?

Last time I mentioned about Paramon on Trendline discussion. That was happening the 3rd time.

Will it happens for the 4th time ? I've entered some at 1.51, lets see how it goes, she may take weeks to repeat the history or she may not repeat the history this time. Lets see how see goes.

Will it happens for the 4th time ? I've entered some at 1.51, lets see how it goes, she may take weeks to repeat the history or she may not repeat the history this time. Lets see how see goes.

Friday 21 September 2012

My first 100th post

I have took more than 1 year to reach my 100th post, well as per my plan I target to write around 2 post per week, which means I should reach my 100th post in less than 1 year. Basically, I'm out by a month. I do want to write sometimes but time really does not allow. Example, last Friday I have entered KLCCP at 5.50 and exited yesterday due to the drastic dropped in CI about 20pt. Actually I wanted to post on Friday just after I took the trade but I'm busy preparing and celebrating my beloved wife birthday, thus I decided to give the post a miss.

This week, I also realised that our KLCI is going for a downtrend as the Lower High has formed. There also somewhat a Head & Shoulder pattern has formed. So, going for MP strategy, the risk has again double up. So, the support 1591~1593 is a key support (the neck line) to monitor closely, if breaks, then all hell broke lose, and we will have to shut all position and comeback around 1553 which is another 40pt. Come to think of today close at 1623, then this will be a -70 pt (-4%) which will at least wipe out 10~20% of most medium to small size counters. So, we really must be more careful and tighten our selection if we really into MP strategy.

This week, I also realised that our KLCI is going for a downtrend as the Lower High has formed. There also somewhat a Head & Shoulder pattern has formed. So, going for MP strategy, the risk has again double up. So, the support 1591~1593 is a key support (the neck line) to monitor closely, if breaks, then all hell broke lose, and we will have to shut all position and comeback around 1553 which is another 40pt. Come to think of today close at 1623, then this will be a -70 pt (-4%) which will at least wipe out 10~20% of most medium to small size counters. So, we really must be more careful and tighten our selection if we really into MP strategy.

Tuesday 11 September 2012

CMMT & Sunreit follow up

When I mention about them on 3 Sept http://reiccs.blogspot.com/2012/09/cmmt-sunreit-rebound.html , both of them did a small dip, well this minor dip, one have to factor into an investment plan. And today CMMT took the lead and hit the 1st resistance 1.80 today and close +5.29% while Sunreit try to catch up from behind (a gap up of 3 sen during the matching time 4.50pm, but volume is not as convincing as CMMT). Wow, what a run for a REITS stocks in such a bad day for FBMKLCI (-19+ around 11am, but recovered back to -6.80). Market breadth was negative with 199 gainers as compared to 604 losers. Lets see, she able to break the resistance convincingly or still need to retrace for a while before going up. Will history repeat for CMMT ? See the yellow shadows and the sketch arrow.

Sunday 9 September 2012

Last week is really breathtaking !

A bad week for trading really is . Drop consecutively for 5 straight days for Small Caps and and only able to breathe for a day due to Dow overnight big rise (244pt). Well, from the chart, a bullish harami was formed on Friday, will our stocks rebound, I need to see how Monday close. If there is a rebound, it would be good till 20MA at least . For trading, the risk has increased. So, lets see are we in confirming a downtrend for FBMSCAP or is there the birth of an uptrend. In a matter of a week or 2 will tell. For me, I did not hold any MP stocks (for trading), I only holding investment stocks (which I would be holding on them for at least 3~12 months). I'm still on a look out should I trade in such a hostile environment or uncertain time.

Monday 3 September 2012

CMMT & SUNREIT rebound !

Technically both of them shows a buy signal .

Will CMMT reach her broke through her 1.80 resistance & reach 1.89 ?

What about Sunreit , will she stay above 1.54 and challenge 1.61 again ?

Well, since both of these stock is my mid to long term investment, and now both of them is still uptrending, reaching both of these targets is a matter of time. Remember both of this Reit moves slowly but surely.

The recent IPO (IGBREIT) may put REITS as a theme play.

Lets see how the listing of IGBREIT will affect them.

I also apply on the IGBREIT, as many analyst give at least a 10% upside, so I join in the wagon, can save a bit on brokerage if selected.

Will CMMT reach her broke through her 1.80 resistance & reach 1.89 ?

What about Sunreit , will she stay above 1.54 and challenge 1.61 again ?

Well, since both of these stock is my mid to long term investment, and now both of them is still uptrending, reaching both of these targets is a matter of time. Remember both of this Reit moves slowly but surely.

The recent IPO (IGBREIT) may put REITS as a theme play.

Lets see how the listing of IGBREIT will affect them.

I also apply on the IGBREIT, as many analyst give at least a 10% upside, so I join in the wagon, can save a bit on brokerage if selected.

Tuesday 28 August 2012

1 Year Anniversary

Time flew by really fast, my blog is 1 year old. Still a baby step, wonder how long I will be writing.

I started this blog with 3 objective :-

1) To record my own trading and the way I deal with each trading or investment.

2) To share my knowledge to any readers who is interested in reading my blog or gaining some basic trading knowledge.

3) To earn some advertisement pocket money though till now is quite disappointing :(

Anyway ...... Lets brace for the sideway to correction coming soon, then we can pick up some cheap

stocks to trade and invest !!!

Sunday 26 August 2012

Review on Sunreit !

Its been more than 1 year since I bought in Sunreit. Since I started learning trading strategy a few years back, I seldom hold a stock for more than 1 year. But for Sunreit, I'm applying dividend yield investoment strategy. Then again, when Sunreit climb agressively last week, I was tempted to sell some and buy back later. I q to sell at 1.65, too bad, she just manage to touch 1.63 on 15Aug12 and retrace back at the very quick pace. Actually I did check that there is a resistance at 1.60 and the 2nd one is 1.65. Since I'm not so eager to sell as I'm investing rather than trading, so I q for her at the 2nd one. Nevertheless, I'm waiting for another BUY signal to add some position again. I just use 2 criteria as buy signal for Sunreit : "price action drop back to 20MA and stochastic 14d at oversold and rebound' . I derived this just from the chart history of Sunreit. Just look at those arrow which indicate a good/reasonable entry point.

Sunday 19 August 2012

Selamat Hari Raya Aidilfitri

Thursday 16 August 2012

MPHB followup - Position close with 8.9% gain

I bought her on Monday 23/July after I posted on her on 21/July

http://www.reiccs.blogspot.com/2012/07/mphb-another-1-more-round.html , I got her at 3.54. After factor in the 5 sen dividend that ex on 30/July, my entry price would be 3.49. I sold today at 3.80 for a gain of 31 sen. She took me near to 1 month before gaining 8.9%. Is it too long for MP ? Well, I think is reasonable as I think for Momentum play, max I can tolerate would be 8 weeks. My initial trading plan is to P at 3.80 as below, then after the dividend, I re-plotted my chart and found that the next resistance is 3.83. Yesterday night after reviewing the chart, I find she was climbing the bollinger band, these make my greed overcome me, makes me thinking of riding the band. Then, I tell my self, stick to my initial plan, so this morning I q 3.83 (still reluctant to follow the initial plan plotted before I took my position). After I found she was smack down after reaching 3.82 (the resistance 3.83 show her color ;) ) and the forming of hanging man candlestick, so I decided to stick back to my old plan and sold at 3.80. See for trading , emotion/greed really need to be checked at all times. Anyway, it she really climbs further, one should not regret, just be happy and grateful that I've close position to "TAKE PROFIT" and not "CUT LOSS".

Chart plotted for trading back on 21/July

Today

http://www.reiccs.blogspot.com/2012/07/mphb-another-1-more-round.html , I got her at 3.54. After factor in the 5 sen dividend that ex on 30/July, my entry price would be 3.49. I sold today at 3.80 for a gain of 31 sen. She took me near to 1 month before gaining 8.9%. Is it too long for MP ? Well, I think is reasonable as I think for Momentum play, max I can tolerate would be 8 weeks. My initial trading plan is to P at 3.80 as below, then after the dividend, I re-plotted my chart and found that the next resistance is 3.83. Yesterday night after reviewing the chart, I find she was climbing the bollinger band, these make my greed overcome me, makes me thinking of riding the band. Then, I tell my self, stick to my initial plan, so this morning I q 3.83 (still reluctant to follow the initial plan plotted before I took my position). After I found she was smack down after reaching 3.82 (the resistance 3.83 show her color ;) ) and the forming of hanging man candlestick, so I decided to stick back to my old plan and sold at 3.80. See for trading , emotion/greed really need to be checked at all times. Anyway, it she really climbs further, one should not regret, just be happy and grateful that I've close position to "TAKE PROFIT" and not "CUT LOSS".

Chart plotted for trading back on 21/July

Today

Saturday 11 August 2012

UOADEV - 2 days reach Profit target (>5.7%)

On 7Aug, after the buy signal, I have set up a trade plan (

E = 1.76, S=1.64, P1 = 1.84 and P2 = 1.98.) This trade is a fast one, reach my 1st Profit target in 2 days, > 5.7%.

Again, one may hope she will reached her 2nd resistance ( 2nd Profit target) with a gain of 13.5%.

For Aggressive short term trader, normally one will target one stock will break the 1st one and reach her 2nd classical resistance. Well, time will tell.

Tuesday 7 August 2012

Another Momentum Play : UOADEV

Recently, she had given a good dividend of 10sen. a

For TA wise, there is a MACD buy signal. So, E = 1.76, S=1.64, P1 = 1.84 and P2 = 1.98.

Many analyst upgrading these stock fair value.

Jupiter : 1.88

CIMB : 2.18

Kenanga : 1.84

For TA wise, there is a MACD buy signal. So, E = 1.76, S=1.64, P1 = 1.84 and P2 = 1.98.

Many analyst upgrading these stock fair value.

Jupiter : 1.88

CIMB : 2.18

Kenanga : 1.84

Thursday 2 August 2012

CMMT follow up - 9% in 3 weeks+

On 9/July I mentioned on CMMT being a good investment stock and also a good trading stock due to her volatility compared to Sunreits. I got in at 1.60 after my posting, so after taking into consideration of dividend 4.2 sen paid, my entry price is adjusted to 1.56. I took profit for half of my position at 1.70, with a 9% gain in less than 1 month which I think is a good short to medium term trade. I decided to keep my other half position, still aiming for next resistance a t 1.89 to offload her. I decided not to keep her if she able to climb till 1.85 in less than one week time.

KLCCP follow up - Gain 9.3% in 4 days

Well, a good short term trade indeed . For short term trader , today she hit my Profit target of 5.4 which is 9.3% gain in 4 days. For those who want some more, tomorrow is a defining moment to see whether she can go up further. But normally, I would like to take profit for half position and let the rest to ride on.

Anyway, for those who prefer to ride on, just monitor closely.

Anyway, for those who prefer to ride on, just monitor closely.

Sunday 29 July 2012

Another Momentum play - KLCCP

Another good stock in play. When she was around 3.1~3.4, I did have a look on her, just found that she is quite range bound and boring stock. I came to observe her is due to her low PE at that time (around 10+). She did give good dividend also (3~4%). Well, for a 3~4 % dividend stock, I don't think is worth keeping for a long time. Recently she has broke out of her range bound stage and keep up trending. I think this is due to the news that they want to unlock their properties value and list their properties as REITS. Last 2 weeks, she has corrected back to 20MA , is it the ripe time to have a long position for a MP strategy ? Well, is up to ones appetite again as the election announcement is getting nearer and nearer, meaning the risk of big correction will be near. So, the RISK will be high. Well , E =4.94, S = 4.64 , P = 5.40. Lets see how she goes from here. As always, caveat emptor.

Saturday 21 July 2012

MPHB - Another 1 more round ?

On 2nd Jul, I jumped into MPHB for a short ride (Momentum Play), I got at 3.41 just before she closes. Then I set my target to sell at 3.69 (for a gain of RM0.28). She did reach a high of 3.69, but I did not sell as greed overcome me, plus I saw the buy momentum was still high, so I go for the next resistance 3.82. So I q every morning, but on 12/Jul, too many things was in my mind, I accidentally q 2.82. Suddenly, I got an alert that my q was done but I dont believe my q was done so early in the morning as yesterday she closes at 3.65. Then I only realise I type wrongly, phew, luckily I did not have so many position and my error q (2.82) was taken up by buyers at 3.65. So, my trade was close with a gain of RM0.24.

Seeing her chart another buy signal has trigger again after she has retraces from 3.72 peak. She is still much in the news of de-merging her Magnum business with the rest of her other business. And the dividend ex date is getting near. So, there may still a last push for her to reach at least 3.72 if not 3.80. Given the Dow and DAX closes badly, around 1% drop, and our KLCI has formed 2 shooting star, this may signal pullback as our CI has been running up for quite a while. So, we may able to get MPHB for a lower price than 20/July closing price 3.67. The stop loss of this trade is below 3.50 but one have to know that the Risk Reward Ratio is not good if we get in at 3.67. So, is up to individual risk appetite on this trade. Just another view, Maybank Investment analyst has selected her as her top picks & give a target price of 3.87 .

Seeing her chart another buy signal has trigger again after she has retraces from 3.72 peak. She is still much in the news of de-merging her Magnum business with the rest of her other business. And the dividend ex date is getting near. So, there may still a last push for her to reach at least 3.72 if not 3.80. Given the Dow and DAX closes badly, around 1% drop, and our KLCI has formed 2 shooting star, this may signal pullback as our CI has been running up for quite a while. So, we may able to get MPHB for a lower price than 20/July closing price 3.67. The stop loss of this trade is below 3.50 but one have to know that the Risk Reward Ratio is not good if we get in at 3.67. So, is up to individual risk appetite on this trade. Just another view, Maybank Investment analyst has selected her as her top picks & give a target price of 3.87 .

Monday 9 July 2012

CMMT -Another Good REIT to consider !

You see that I have been keep Sunreit for nearly a year. She has been trending up since the day she launch. A bit boring stock but good for long term investor.

Another REIT that worth mentioning here is CMMT. She also has been trending up since she was launched but this one I miss to purchase as during that time I just decided to pick one for a long term investment. Then after on and off, I do have a peek on her. She is more volatile in daily terms. So, I think now is a good time for me to purchase some. I realise in these 2 days there are some big fish (5000 lots each time and high buy rate) eating her up till 1.67~1.69 but due to no follow up buy queue to support the medium fish seller, the price went back down to where she is at the opening bell. If the big fish still have more budget buying in then I believe all the medium fish will be drained off in a matter of time and the price will eventually go up, at least back to 1.75. So, lets see how she goes. For CMMT, I believe even short term play is also viable.

Another REIT that worth mentioning here is CMMT. She also has been trending up since she was launched but this one I miss to purchase as during that time I just decided to pick one for a long term investment. Then after on and off, I do have a peek on her. She is more volatile in daily terms. So, I think now is a good time for me to purchase some. I realise in these 2 days there are some big fish (5000 lots each time and high buy rate) eating her up till 1.67~1.69 but due to no follow up buy queue to support the medium fish seller, the price went back down to where she is at the opening bell. If the big fish still have more budget buying in then I believe all the medium fish will be drained off in a matter of time and the price will eventually go up, at least back to 1.75. So, lets see how she goes. For CMMT, I believe even short term play is also viable.

Saturday 7 July 2012

Genting SP - Do you still fond of ?

I remembered, in 2009, everyone was talking about buying her . My friend, my mom, my sister, her friend, many others talk about buying her when she was around S$1.20. Well, I didnt get any as I feel the high brokerage and the exchange rate loss deter me from investing her. She really did climb to her high 2.33 around Nov2010. Since then she has been slowly trending lower before she caught in a SIDEWAY CHANNEL since Aug2011. And now, she is at her lower channel line again, broke slightly below the lower channel line of 1.41. She is now trading around 1.385 ~ 1.42. So, is it a good buy now ?

Well, 2 weeks back I was attending Maybank Fundamental Analysis Talk by KimEng/Winson, he did mention, buying Genting SP at 1.41 would be a good buy in terms of FA point of view. Coincidentally, TA point of view is also good. So, what do you all think ?

My take is if this support 1.385~1.42 hold, then after collecting it, one would have to patiently wait to P around 1.74 (22%). If this important support breaks, then I would wait for 1.24~1.28 for a tactical entry.

My take is if this support 1.385~1.42 hold, then after collecting it, one would have to patiently wait to P around 1.74 (22%). If this important support breaks, then I would wait for 1.24~1.28 for a tactical entry.

Monday 2 July 2012

2012 Q2 Trade/Investment Summary

Is time again for another review. This time is a 50/50 for me, 2 lost, 2 win. The most important here is money management and risk reward to ensure profit even with only half of the trades taken go my way. I'm still keeping my Sunreits as a long term investment stock. See that my holding days is less than 1 year while my Paper profit has reached 31.4%. This round, you can see that one need not monitor the market everyday or being an active trader, the profit from VI (Value Invest) has better gain than my MP (Momentum play) trades.

Saturday 23 June 2012

Trend channel follow-up -Paramon

On 10Mar2012, I mentioned Paramon when she is trending near the bottom of her channel, see below for part of my comment or you may need to refresh in details what I have wrote at http://reiccs.blogspot.com/search/label/Paramon

......"So, how to play ?

To those traders that does not want to miss the opportunity, one should enter position if Monday intraday can goes higher than 1.61. These again based on probability, the true support may not be 1.58, so one should enter with a smaller position and keep some remaining bullets to average down at 1.52 if really the trendline A is the way the market really wants Paramon to go.

What about you are conservative ? So, just wait till 1.52 to enter, if she really doesn't goes down to this level, just forget about her and moves on to hunt for another better probability stocks....."

Today's comment

On 23Apr, she started to trade around 1.52 which even the conservatives also can enter. Remember ! even with TA, one cannot be accurate till the exact cents level when I mention about target entry price.

As of 21/June/2012 (is been 3 months +) , she has finally reach back her upper channel line, awesome right ? One can have his own sweet time to purchase around 1.51~1.62 as she fluctuate on these range for about 2 months. Meaning there is no rush in buying when she has reach the bottom of the channel line.

So, is it time to sell now? If on3 were to follow the trend channel game plan, it is time to sell. Again, remember one cannot get every juice out of an orange. She may breakout from the upper channel line but hey with this channel range, one already profit 18% for a mere 3 months period. One should not be greedy.

Thursday 14 June 2012

FBMKLCI trend: Sideway or Downward ?

Our CI is at the edge of the "Megaphone" channel. Looking at the Stochastic, she has a high possibility to move downwards if the 100MA not able to sustain. Let see how she goes on tomorrow. If she breaks back into the channel, then we must get ready for the rough ride downwards....

Wednesday 6 June 2012

Follow up on TSH

On 18May, I post on the missing the cut loss point & hope for a fruitful rebound.

"d) What if you miss the boat, and now is too painful to cut, there is still a last chance where she may have a technical rebound back to 2.26 though the rebound may realize or may not realize. So, thats where the HA (Hope Analysis) come in.......;)"

Finally, today she has reached the 2.26 initial cut loss point. For a Trader who follow his/her strategy strictly, today he should cut loss at 2.26~2.27 and do not "hope" there is further upside to recover his loss. This is due to his initial trading plan has failed and he has to bear the small loss. For a trader, the strategy is to maintain cash always to fight another day by having small loss and having more than 50% success rate of overall position taken.

But for an medium term investor, one would have average down around 2.12 and wait for this rebound to check one can profit from his average price. In this circumstances, being and investor and to let him escape the pain of being actual real money loss while bearing only paper loss. Being a medium term investor, he must have enough money in his portfolio in order for him to average down (the best method is dollar cost averaging).

So, which Method you prefer ???? Again whether one is a pure trader or investor, a well trained MIND, a proper defined and back test METHOD and MONEY MANAGEMENT still applies.

"d) What if you miss the boat, and now is too painful to cut, there is still a last chance where she may have a technical rebound back to 2.26 though the rebound may realize or may not realize. So, thats where the HA (Hope Analysis) come in.......;)"

Finally, today she has reached the 2.26 initial cut loss point. For a Trader who follow his/her strategy strictly, today he should cut loss at 2.26~2.27 and do not "hope" there is further upside to recover his loss. This is due to his initial trading plan has failed and he has to bear the small loss. For a trader, the strategy is to maintain cash always to fight another day by having small loss and having more than 50% success rate of overall position taken.

But for an medium term investor, one would have average down around 2.12 and wait for this rebound to check one can profit from his average price. In this circumstances, being and investor and to let him escape the pain of being actual real money loss while bearing only paper loss. Being a medium term investor, he must have enough money in his portfolio in order for him to average down (the best method is dollar cost averaging).

So, which Method you prefer ???? Again whether one is a pure trader or investor, a well trained MIND, a proper defined and back test METHOD and MONEY MANAGEMENT still applies.

Monday 4 June 2012

TPMS is really useful !

Since the market is bearish, there is nothing to buy at the moment. I'm hibernating in terms of trading.

So, I decided to blog on Tyre Pressure Monitoring System (TPMS) which I find it very useful for a car owner. Well, not many car have this, to my knowledge, BMW has it but the feature is only a light indicator which will light up when the tyre pressure is low.

I have one install in my car, an accessories selling after market. The display shows information on Pressure & Temperature of my car's each tyre. I find having it is very useful, as just today itself, I was safe the hassle of having to change a punctual tyre or maybe worse still, damage my tyre sports rim.

I was driving home around 8pm+, suddenly I heard a knocking sound below my car. Then in less than a 10 sec, I heard my TPMS beeping. The display showed my back left tyre only left with 145 kgf only of air pressure (Normally, I pumped to 210 kgf according to my car factory recommendation).

Immediately I turned to a nearby petrol station. Once reached, eventhough is less than 2 minutes,

my tyre pressure has left with 47 kgf. I said to myself "shit!", is a serious punture.

I tried to pump the tyre pressure up, in order for me to have some air pressure to drive to a nearest tyre shop if there is still any "OPEN" at this point of time (is 8.45 pm). But, the pump not able to put in any air into the tyre. Again, I feel more anxious.

Then, a guy who has just pumped his motorbike told me, I got to get it repair and just point me to a shop just beside. Mind me, I was so engrossed on getting my tyre pump up, didnt really realise there is a tyre shop still open just beside the petrol station. So, I just drive my car slowly there, bearing in mind that my tyre is totally out of air and I dont want to damage my sports rim.

When the repair guy remove my tyre, I saw the tyre was totally puncture about a centimetre crack line. Really wonder what causes this damage. Bad luck !!! In my heart, I was hoping, the repair guy able to repair it. He put in the first "glue nail" (dont know what is actually call), and the soap water bubble still poping, then he put in another "glue nail', still bubbles popping. Then I thought to myself, like this I got to spend RM200 for another new tyre and the worst thing is my tyre is just 1 month+ old ! Luckily he didnt give up, he give another "glue nail", then he check the bubbles again, he smile to me and said , DONE !. I'm a bit skeptical on the repair success as the 3 "glue nail" was put into a single crack line. So, he assembled back my tyre and I paid him.

The only thing to do now is, I got my TPMS to monitor whether the repair has definitely stop the leakage or not. When the TPMS is running, I found he has pumped up to 255 kgf which is very high pressure but I don't bother to release the air as I want to monitor whether there is any more leakage or not. The distance from the shop till my home is less than 2 km, I monitored the pressure and is still at 255 kgf when I reached home. But I still need to monitor it tomorrow to be sure of the the sealing job.

So, you see, a TPMS installed in a car is really useful. Thanks to the TPMS, my tyre puncture problem

can be known earlier and able to avoid things like accident, rim or tyre damage or even miss an appointment due to last minute only found out the tyre is totally flat.

Tuesday 29 May 2012

Update on Trading a company that being take-over (Leader)

In Nov2011, I mentioned on trading/investing on Leader would be a safe strategy if one manage to observe the chart carefully. The price movement will tell whether the takeover really is serious or not. And on 16/May, she has traded at RM1.10 (the take over price), so I decided to take profit. I only managed to sell at RM1.09 since too many lots were queued at RM1.10 which I've tried for a few days and not successful.

So, is it okay for a gain of 11% for a 6 month period ? Well, I think is quite good, imagine you only can get 1.5% for 6 months period if you put your money in FD.

For more details of how to observe a chart, you can check back the link below.

http://www.reiccs.blogspot.com/search/label/Privatisation

So, is it okay for a gain of 11% for a 6 month period ? Well, I think is quite good, imagine you only can get 1.5% for 6 months period if you put your money in FD.

For more details of how to observe a chart, you can check back the link below.

http://www.reiccs.blogspot.com/search/label/Privatisation

Friday 18 May 2012

Lesson to be learned from May Momentum play

On 1st May , I wrote the below for TSH momentum play

" Entry would be around 2.44. (maybe can get around 2.42 or maybe 2.44 would be the lowest)

Stop Loss = 2.26

Profit = 2.67 (1st target) 2.81 ( 2nd target).

Target time = 2 ~ 4 week max "

On 16/May, she broke down & straight punch through the support without a pause. She then close at RM2.18 which is RM0.06 below the plan stop loss 2.26. For such a BEARISH MARKET where index fell more than 20 pts, one would take action as below :

a) During intra-day, if he/she is monitoring the market closely, no need to wait for end of the day, immediately cut, maybe can cut at 2.24~2.26. At least is still near or according to the plan cut loss.

b) If he/she is not monitoring the market, cut the next day, even the next day is an up day, just cut at 2.18 or just observed a bit if index up, so maybe can cut around 2.21. Remember a cut loss plan is a plan that must follow strictly as a trader though one may like to tweak a bit on the cut loss criteria (see comment c). In this scenario, she keeps going lower & further away from thecut loss target. On 18/May, she is at 2.10, you will lost another RM0.16 per share in addition to the cut loss target (-RM0.18). Imagine if you have 10 lots (10,000 units), you would have lost another RM1600 in just 2 day of hesitation or procrastination.

c) What if the scenario is the index is NOT in such BEARISH situation. If the stock slowly creep lower and broke below the 2.26, say by RM0.02. One can still wait for the next day to see how she closes. If close above the support, then there is a chance there is a whipsaw here or some syndicate purpose flush out the tight stop loss trader. So, is good to hold 1 more day to observe the price direction if the general market does not have a BEAR charging at you.

d) What if you miss the boat, and now is too painful to cut, there is still a last chance where she may have a technical rebound back to 2.26 though the rebound may realize or may not realize. So, thats where the HA (Hope Analysis) come in.......;)

" Entry would be around 2.44. (maybe can get around 2.42 or maybe 2.44 would be the lowest)

Stop Loss = 2.26

Profit = 2.67 (1st target) 2.81 ( 2nd target).

Target time = 2 ~ 4 week max "

On 16/May, she broke down & straight punch through the support without a pause. She then close at RM2.18 which is RM0.06 below the plan stop loss 2.26. For such a BEARISH MARKET where index fell more than 20 pts, one would take action as below :

a) During intra-day, if he/she is monitoring the market closely, no need to wait for end of the day, immediately cut, maybe can cut at 2.24~2.26. At least is still near or according to the plan cut loss.

b) If he/she is not monitoring the market, cut the next day, even the next day is an up day, just cut at 2.18 or just observed a bit if index up, so maybe can cut around 2.21. Remember a cut loss plan is a plan that must follow strictly as a trader though one may like to tweak a bit on the cut loss criteria (see comment c). In this scenario, she keeps going lower & further away from thecut loss target. On 18/May, she is at 2.10, you will lost another RM0.16 per share in addition to the cut loss target (-RM0.18). Imagine if you have 10 lots (10,000 units), you would have lost another RM1600 in just 2 day of hesitation or procrastination.

c) What if the scenario is the index is NOT in such BEARISH situation. If the stock slowly creep lower and broke below the 2.26, say by RM0.02. One can still wait for the next day to see how she closes. If close above the support, then there is a chance there is a whipsaw here or some syndicate purpose flush out the tight stop loss trader. So, is good to hold 1 more day to observe the price direction if the general market does not have a BEAR charging at you.

d) What if you miss the boat, and now is too painful to cut, there is still a last chance where she may have a technical rebound back to 2.26 though the rebound may realize or may not realize. So, thats where the HA (Hope Analysis) come in.......;)

Sunday 13 May 2012

Happy Mother's Day

Wish every mother a HAPPY MOTHER'S DAY !!!

Yesterday, we have celebrated and this time we celebrated at home by having steamboat. We celebrated with 2 mother (my mom and my mother in law) together with my brother in law family. The above cake was custom order by my beloved wife. The above cup cakes represent everyone that were in the celebration and the center cake will represent my mom & mom in law.

Wednesday 9 May 2012

VI with TA ?: Coastal May2012 followup

Finally Coastal has rebound from her down trending and now there is a TA buy signal in the making. See the purple oval shadow ? Would it be a history repeat ? A close above 50MA (above 2.11) would signal a buy. Again for those hardcore investor, its time to accumulate againor average down for those who got in a bit too high (with careful money management). Lets see this strong FA stock able to climb up and go against the overall weak market sentiment.

Time will tell.

As always caveat emptor.

Time will tell.

As always caveat emptor.

Tuesday 1 May 2012

A Momentum Play for May ? TSH would be a good bet

A purely TA play. Weak overall market sentiment but this stock is a strong uptrending stock. As one of my trading comrades name it, TSH is having a perfect chart.

Candle : Inverted hammer sighted

Stochastic : At oversold (would be safer to entry)

Support : Buy at 20MA support (buy low sell high ?)

Entry would be around 2.44. (maybe can get around 2.42 or maybe 2.44 would be the lowest)

Stop Loss = 2.26

Profit = 2.67 (1st target) 2.81 ( 2nd target).

Target time = 2 ~ 4 week max

Lets see hows she react from this.

Just a side note :

My nuffnang advertisement earnings is very low, hope to get more support ;) from all my readers here.

Thursday 26 April 2012

SELL IN MAY AND GO AWAY !

May is very near....Remember the old saying in trading ...."Sell in May & Go Away".

Why is this so???.... Hmmm, maybe because of the School holiday ??? Where the Fund Managers

will sell their holdings and go for vacation with their family ??? Or maybe in this 2012 will be a up year

for month of May ?

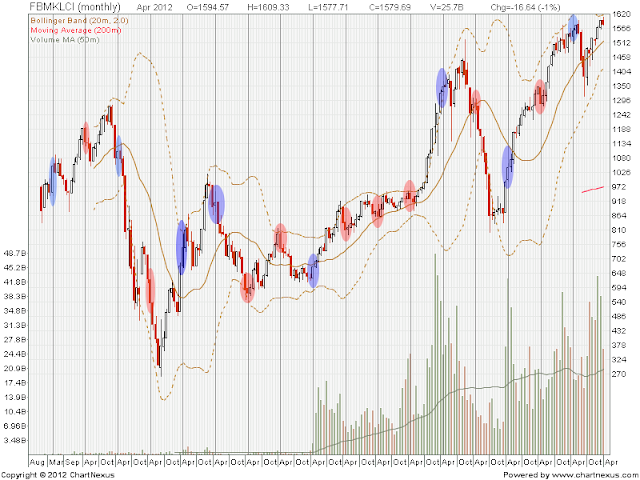

Lets check the history data, actually I would like to take a look only at the FBMSCAP rather that FBMKLCI cause in FBMSCAP consist of more stocks which most of us will buy into it. But my data only have 3 years of this and the result is 2 down/ 1 up, so is 67% probability (anyway I think the data would be too little to show). See below

Let see FBMKLCI , is 9 down/8 up which is only 53% . So, the saying of Sell in May & go away is not so valid for our Malaysia market. So, lets see how this 2012 May will display a Red Candle or a White Candle. My pick is a Red one. Time will tell :)

Why is this so???.... Hmmm, maybe because of the School holiday ??? Where the Fund Managers

will sell their holdings and go for vacation with their family ??? Or maybe in this 2012 will be a up year

for month of May ?

Lets check the history data, actually I would like to take a look only at the FBMSCAP rather that FBMKLCI cause in FBMSCAP consist of more stocks which most of us will buy into it. But my data only have 3 years of this and the result is 2 down/ 1 up, so is 67% probability (anyway I think the data would be too little to show). See below

Let see FBMKLCI , is 9 down/8 up which is only 53% . So, the saying of Sell in May & go away is not so valid for our Malaysia market. So, lets see how this 2012 May will display a Red Candle or a White Candle. My pick is a Red one. Time will tell :)

Wednesday 18 April 2012

April12 Momentum Play : UOADEV

I've been observing the UOADEV recently and realised that she has just breakout from a symmetrical triangle and may have a chance of climbing the bollinger band. Well, at this price RM1.54, for those not particular on a few sen, it would be a good entry point.

TA positive view

1) Breakout of symmetrical triangle

2) MACD line bullish crossover and cross zero line recently

3) Volume is picking up

4) Daily & Weekly MACD histogram at 2G (bullish).

TA negative view

1) Stochastic at overbought level

2) Red candle today

3) General market sentiment weak & Properties index is on downtrend

For aggressive trader, one can enter tomorrow at 1.54. For conservative trader, one can enter when stochastic return to oversold level (maybe around 1.51). Stop loss should be 1.49 (should not hesitate as the overall market is quite weak ). Remember the saying "Sell in May & Go away".

Happy trading. As always caveat emptor.

TA positive view

1) Breakout of symmetrical triangle

2) MACD line bullish crossover and cross zero line recently

3) Volume is picking up

4) Daily & Weekly MACD histogram at 2G (bullish).

TA negative view

1) Stochastic at overbought level

2) Red candle today

3) General market sentiment weak & Properties index is on downtrend

For aggressive trader, one can enter tomorrow at 1.54. For conservative trader, one can enter when stochastic return to oversold level (maybe around 1.51). Stop loss should be 1.49 (should not hesitate as the overall market is quite weak ). Remember the saying "Sell in May & Go away".

Happy trading. As always caveat emptor.

Subscribe to:

Posts (Atom)

.JPG)